6-Step Guide: How To Save, Invest, And Build Wealth

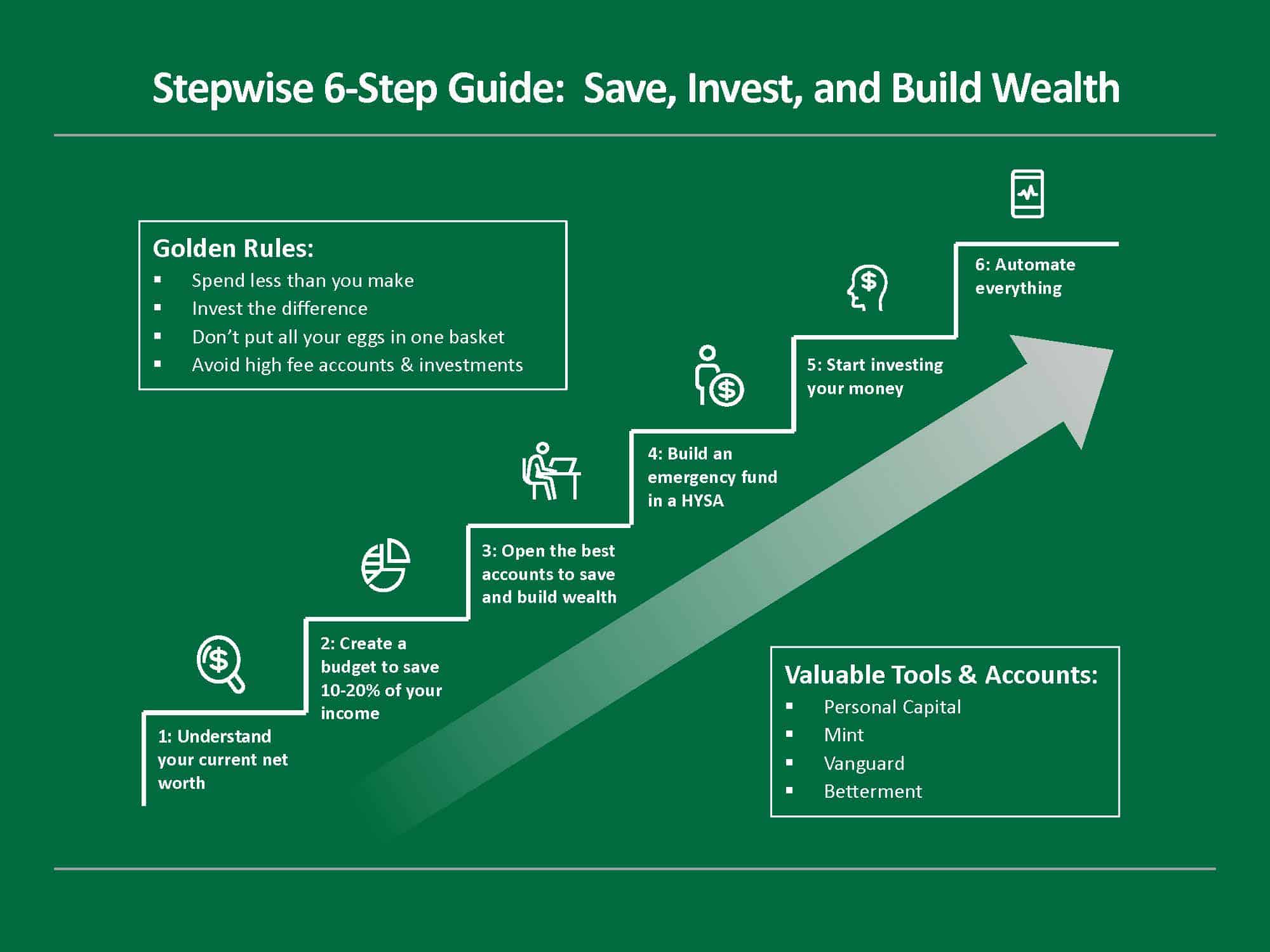

Often the hardest thing about investing is figuring out where to start.

Depending on your risk profile and how your parents raised you, investing can feel either really scary or natural to you. With so much contradicting advice online, it’s important to stay grounded. Despite what many people think, you don’t need to pay a financial advisor exorbitant fees – in fact, we don’t recommend this.

If you follow our simple process, you’ll learn the same step-by-step tactics the top 1% uses to build wealth responsibly.

First, start with retirement planning: max out your retirement accounts (IRA and 401(k)) to benefit from tax-advantaged investing.

Not all investment accounts are created equal. For instance, did you know that retirement accounts have tax advantages? The most common retirement accounts are a 401(k) or IRA (Roth IRA or Traditional). For this reason, your first investments should go into one of these two accounts.

If your employer offers a matching program with your 401(k) option, you should use this account first. Why? Because “matching” is code for free money. It’s like earning passive income.

If you don’t have a matching program with your 401(k), then we recommend using your IRA account first because they tend to have better investment options.

Now, the question is which type of account: Roth or Traditional?

While there are many differences, generally speaking, Roth is the best choice for building wealth and accessing your money. Two big benefits of Roth accounts are that you don’t pay taxes when you take money out and you can access the money you contributed before you retire, if needed.

Second, invest any extra money in your brokerage account.

Contribute to your brokerage account(s) last.

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and exchange traded funds (ETFs).

You might have heard of the following ones: Public, E-Trade, Robinhood, Fidelity, or Vanguard. Although brokerage accounts get a lot of press and attention, they are actually the last step in the investment process. Why? Because these accounts don’t offer any special tax advantages.

You shouldn’t worry about brokerage account investments until you are already maxing out your annual retirement accounts, IRA, and 401(k) contributions.

|

Disclaimer: One exception to this rule is if you have a plan to retire early (before the age of 60). In this scenario, contributing to your brokerage account in parallel with your retirement accounts (i.e. before maxing them out) may make sense. Any money you withdraw from a retirement account before retirement age (~60 years old) is subject to a 10% early withdrawal penalty. If you plan to retire early, it may make sense to build investments in non-retirement accounts as well. |

In terms of what to invest in, you might feel tempted to invest in individual stocks. We get it, it feels more “fun.” But that’s called “speculating”, not “investing.” You’ll experience very little financial stability this way.

When investing, stick to index funds and exchange traded funds (ETFs) for 80%+ of your portfolio, if not the whole thing. Why? Because they are well-diversified and low-cost – two things you want in any investment strategy.

You can keep it very simple by using a robo-advisor, which can help pick ETFs for you. If you want to be a bit more involved, you can buy a target-date retirement index fund, or just a total stock market index fund to get started, via a brokerage account like Vanguard.

To recap, here are some action items:

- Max out your IRA and 401(k) contributions first.

- Only after you max out your tax-advantaged accounts, put money in your brokerage investment account.

- When picking investments, stick to low-cost and diversified index funds and ETFs.